Customizing Charts on the MT5 Platform for Prop Trading Success

You’ve probably already come to the conclusion that accuracy, timeliness, and clarity are crucial if you trade with a prop business. Having a neat and personalized chart layout on your MT5 platform isn’t just a nice touch; it’s a game-changer since every second matters. There isn’t much space for confusion or clutter when trading firm money. Your charts must be clear, easy to understand, and customized to your trading preferences. To make your MT5 charts work for you rather than against you, let’s take a closer look at how to modify them.

Why Chart Customization Even Matters in Prop Trading

Prop firm trading has a significant risk. You’re either actively managing someone else’s money with strict risk limitations or demonstrating your abilities to secure funding. Because your setup wasn’t perfected, you can’t afford to be sifting through noisy charts or missing entries.

The MT5 layout by default? It works. However, it is general. A standard car will get you from point A to point B, but it won’t win races. It’s like attempting to race Formula 1 with one.

Customizing your charts does more than simply make them look nice. You’re creating a trading cockpit that is tailored to your approach to risk management, market analysis, and entry spotting. That extra advantage might mean the difference between exceeding a maximum drawdown limit or reaching your daily goal.

Getting Started: Clean Slate or Chaos?

You’re most likely seeing black backdrops with green and white candlesticks if you haven’t altered your MT5 chart settings. That’s excellent if it works for you. However, that basic arrangement may quickly become confusing for most traders, particularly those who depend on visual cues or many indicators.

Step 1: Right-Click and Go to Properties

To access “Properties” on your chart, simply right-click anywhere on it or press F8. This provides access to all of your chart’s graphic components.

Colors and Common are the two tabs you will notice.

The backdrop, grid lines, candles, wicks, volumes, and foreground (price levels and time) may all be altered in the Colors tab. Do you want simple red and blue candlesticks on a white background? Completed. Would you rather have a gray, simple design without any grid? That’s something you can do too.

Advice: Choose an eye-friendly layout if you trade for hours every day. Although it may seem nice, high contrast will damage your retinas after five hours.

Step 2: Switch Off the Noise

Under the Common tab, you can turn off a bunch of stuff you probably don’t need—like the grid or the Ask line—especially if it’s distracting. Less is more.

You can also choose your chart type here: candlesticks, bars, or line charts. For most prop traders, candlesticks are the go-to since they show a lot of info in a compact visual. But hey, you do you.

Templates: The Shortcut to Consistency

Once you’ve got a chart you like, don’t just admire your work—save it as a template.

Just right-click the chart, choose Template then Save Template. Give it a name like Clean Swing Setup or Scalper View—whatever makes sense for you.

This is super handy if you’re monitoring multiple assets or trading across timeframes. Instead of customizing every chart from scratch, just apply your saved template and boom—you’re set.

Also, MT5 lets you set a default template. So every time you open a new chart, it’ll automatically use your custom layout. Just name your favorite template “default.tpl” when you save it, and MT5 will use it as the go-to.

Add Your Tools: Indicators, Lines, and Objects

Now that your chart looks the part, it’s time to load it up with the tools you actually use to trade.

Indicators

MT5 has all the classic indicators built-in—moving averages, MACD, RSI, Bollinger Bands, you name it. Drag and drop them onto your chart from the Navigator window, or click the Insert tab at the top and head to Indicators.

But don’t go overboard. Just because you can stack five indicators doesn’t mean you should. Try sticking with what you actually use in your strategy.

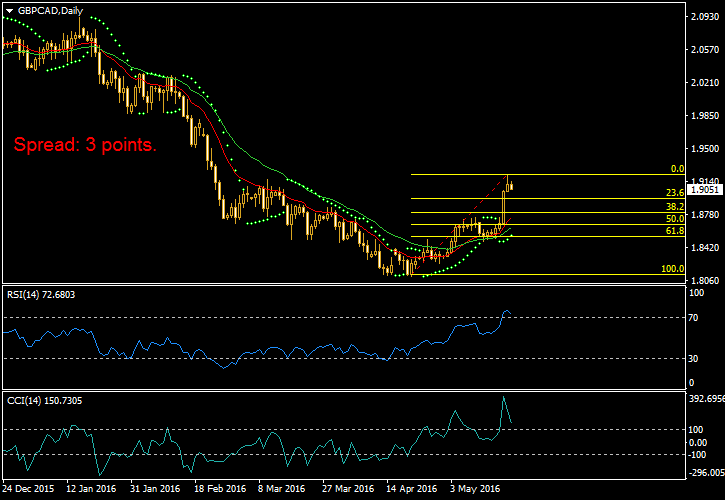

A funded trader scalping gold might rely on 20 EMA and VWAP with a couple of volume indicators for MT5. A swing trader might use RSI, Fibonacci levels, and daily pivots. The key is to make your chart readable, not ridiculous.

Drawing Tools

Horizontal lines, trendlines, Fibonacci retracements—these are your best friends for marking levels and zones. You’ll find them in the toolbar or under Insert > Objects.

You can also change how each object looks—color, thickness, even dash patterns—by double-clicking it, right-clicking, and choosing “Properties.” It sounds small, but it helps keep things visually organized.

Pro tip: Use different colors for different types of levels. For example:

- Green lines for support

- Red lines for resistance

- Blue dashed lines for psychological levels (round numbers)

That way, your brain immediately knows what it’s looking at without second guessing.

Timeframes: The Multi-Chart Setup

Most prop traders use more than one timeframe when analyzing trades. Maybe you’re looking at the H1 for structure, M15 for execution, and M5 for entries.

MT5 makes it easy to set up multiple charts side by side. Just open multiple chart windows, apply your template to each, and arrange them using Window > Tile Windows.

You’ll thank yourself later when you can see the bigger picture and your precise entry setup all at once—no constant clicking back and forth.

Profile Management: Keep Your Layouts Organized

If you trade multiple strategies or asset classes, you can go one level deeper with Profiles.

Let’s say you’ve got one chart set up for trading EURUSD using trend-following strategies and another for scalping US30. Each needs different indicators, objects, and timeframes.

Instead of redoing your layout every time you switch assets, save each setup as a Profile. You can do this from the bottom left of MT5 or go to File > Profiles. Create as many as you want and switch between them in two clicks.

This is a must-have trick for prop traders who handle multiple markets or strategies.